Housing Affordability Reaches Record Low, PropTrack Reports

Housing affordability in Australia has plunged to its worst level on record, according to PropTrack’s latest Housing Affordability Index. A year of soaring interest rates and rising home prices have made homeownership an even more distant dream for many Australians.

The decline in affordability is driven by persistently high mortgage rates, at levels last seen in 2011, combined with a staggering $50,000 increase in the national median home price over the past 12 months. As a result, households across various income levels can afford to buy the smallest proportion of homes since records began.

A Rapid Decline in Affordability

A household earning the median income of just over $112,000 a year can now afford only 14% of homes sold across the country—a sharp drop from 43% just three years ago. This data, highlighted in the 2024 PropTrack Housing Affordability Report, shows how severe the housing crisis has become for Australians.

The combination of skyrocketing home prices and the highest interest rates in a decade has resulted in the worst housing affordability conditions on record. From July 2023 to June 2024, households at all income levels could afford fewer homes than at any time since 1995.

While affordability saw improvement following the Global Financial Crisis, peaking in 2020 and 2021 when interest rates were at record lows, this relief has quickly reversed. Since mid-2022, rising interest rates and home prices have made homeownership harder than ever, particularly in New South Wales, Tasmania, and Victoria, where housing affordability is at its worst.

State-by-State Affordability Challenges

New South Wales, Victoria, and Tasmania are the states where households face the toughest challenges in affording homes. Sydney’s median house price of $1.5 million makes New South Wales the least affordable state, while Tasmania ranks second worst, with a median-income household able to afford less than 10% of homes sold in the past year. Even in Victoria, where home prices are lower than in Sydney, affordability is still below the national average, with median-income households able to afford only 12% of homes.

South Australia recorded the biggest drop in affordability over the past year, while Western Australia remains the most affordable state, attracting many buyers and fueling rapid price growth.

Saving for a Deposit: A Major Hurdle

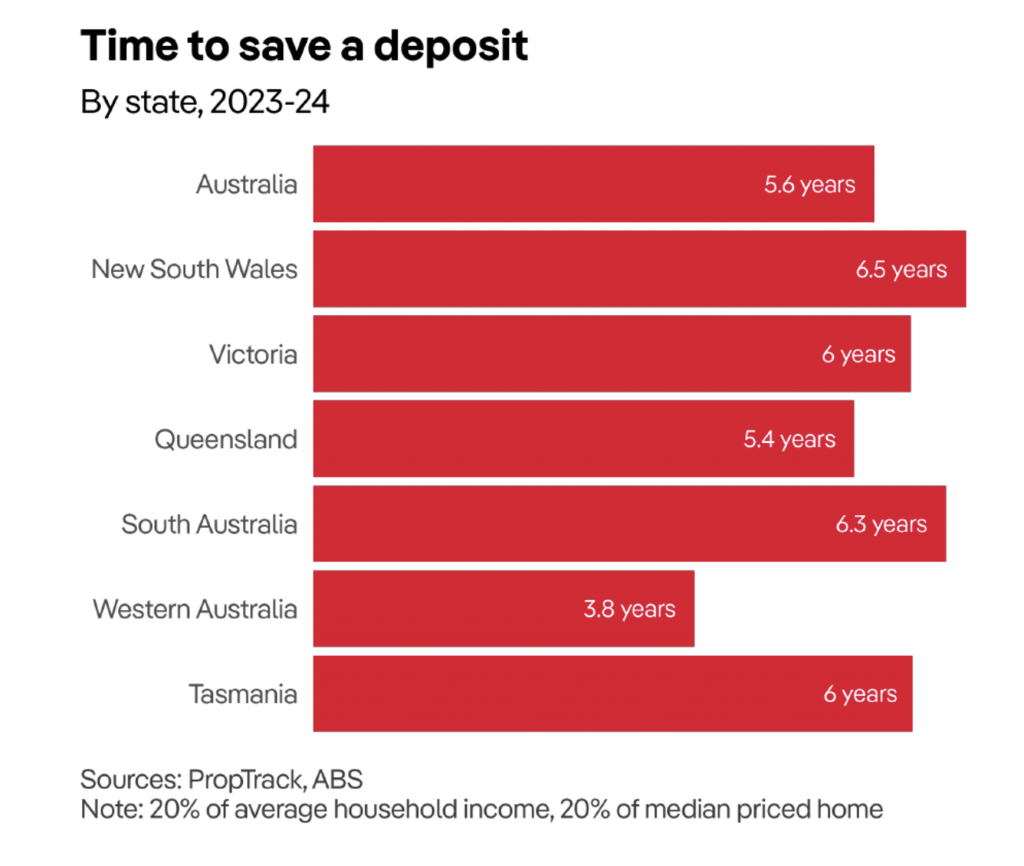

Even for first-home buyers who can afford mortgage repayments, saving for a deposit remains a significant barrier. An average-income household would need to save 20% of their income for more than five and a half years to accumulate a 20% deposit on a median-priced home—challenging for many who are also paying rent.

Only High Earners Can Afford Homes

A median household, earning just over $112,000 annually, could afford only 14% of homes sold nationwide over the past year. This is the lowest share since records began in 1995 and a steep decline from 2020–21, when 43% of homes were within reach for median earners. Now, households need an income of $213,000 (the top 20% of earners) to afford half of the homes sold in Australia.

Rising incomes since the pandemic have failed to offset the sharp rise in home prices and mortgage rates, squeezing out middle-income families from the housing market.

Will Affordability Improve?

While lower interest rates could offer some short-term relief, long-term improvements in housing affordability will require structural changes to the housing market. The solution lies in building more homes. The National Cabinet’s goal to construct 1.2 million well-located homes is a promising start, as are ambitious zoning reforms from some state governments. These measures have had a positive impact overseas, but achieving meaningful progress will require a coordinated national effort.

Additionally, policies such as reducing stamp duties, which penalize buyers looking to right-size their homes, could help make more housing available to growing families.

Market Momentum Slowing

After years of rapid price growth, the Australian property market is finally showing signs of losing momentum. According to CoreLogic’s latest Home Value Index, only half of Australia’s capital cities—Sydney, Brisbane, Adelaide, and Perth—saw price increases over the September quarter, with every other city recording declines.

Even in hot markets like Perth and Adelaide, growth has slowed. Sydney’s median home price rose by just 0.5% in the September quarter, the lowest rate of growth since early 2023, and this cooling trend is expected to continue. Over the next six months, experts anticipate a continuation of this slowdown, driven by an increase in housing stock, slower population growth, and the possibility of an interest rate cut.

Let us help!

If you’re considering buying or selling a property and seeking to understand the current market conditions, why not chat with one of our friendly agents to understand how we can help?

Or feel free to click here to get your instant property estimate.