Australian property prices have hit record highs, with the median home value reaching new peaks in June. However, there’s a silver lining for potential buyers: the rate of price increases has slowed to its lowest level in 18 months.

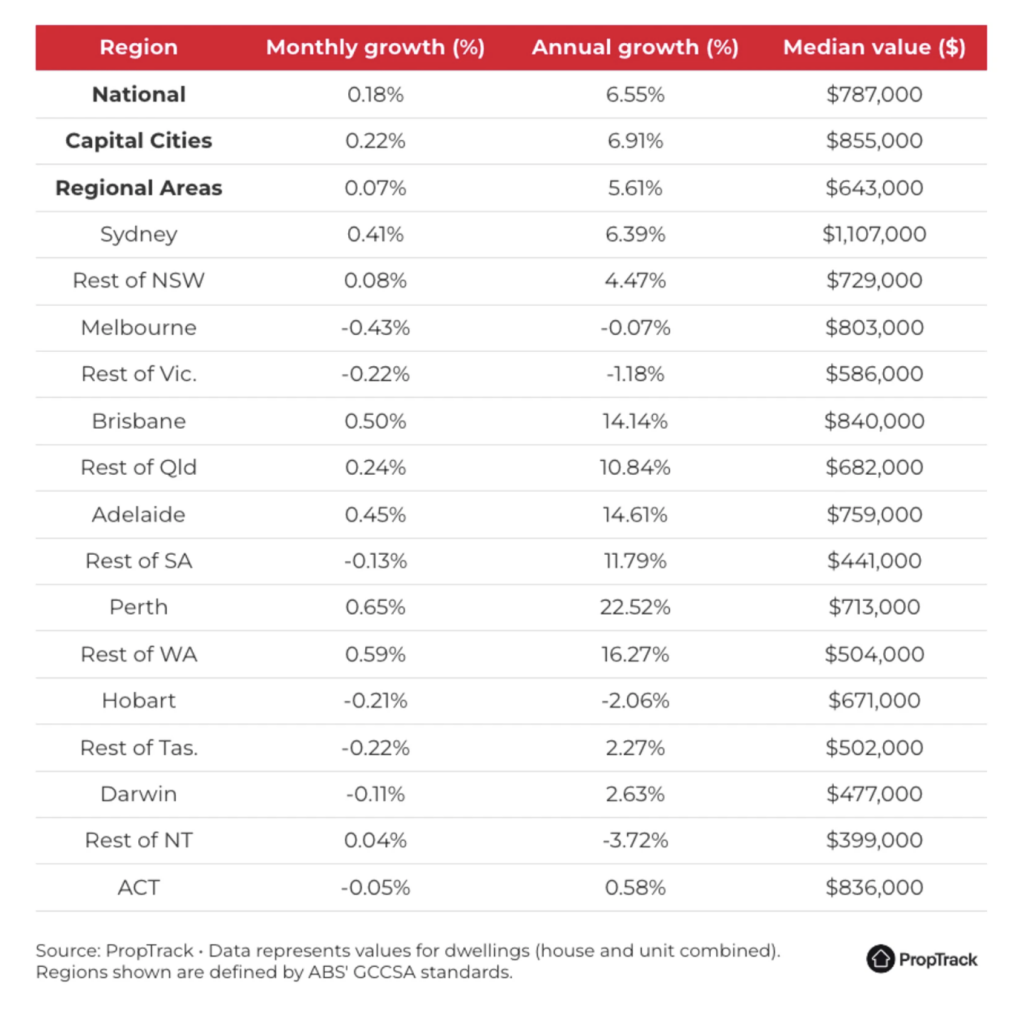

According to the latest PropTrack Home Price Index, national prices rose by 0.18% in June and have increased by 6.55% over the past year. This moderation in price growth is a relief for buyers worried about escalating prices making homeownership unattainable. Despite a series of interest rate hikes since mid-2022 reducing borrowing capacities by about 30%, strong demand for homes, especially where supply is limited, has kept prices high.

The easing growth trend is evident across all capital cities as more properties come onto the market, providing buyers with greater choice. The market dynamics have shifted with the end of the summer selling season, allowing buyers more negotiating power.

Boosting buyers

Buyers are also expected to have more money to spend on property from today as the stage three tax cuts come into effect, boosting buyer’s borrowing capacities by tens of thousands of dollars. A homebuyer earning $100,000 a year will get a $2,179 tax cut, boosting their borrowing capacity by about $25,000, while a buyer earning $150,000 will save $3,729, allowing them to borrow about $37,000 more. However, while these cuts will bolster incomes and borrowing capacities, they may also contribute to increased price pressures.

The RBA kept interest rates on hold last month, with the board discussing a rate hike but not considering a rate cut at all. Australia’s median home value increased by 6.55% over the past year, with prices growing a little faster for houses (6.74%) than units (6.6%). But in some cities, growth has been much more rapid than that.

How home prices changed around Australia in June

Perth’s median house price has risen an incredible 23% in the past year alone, clocking the fastest growth in values of all the capitals to a record high of $762,000. Meanwhile, the median house price in Adelaide has cracked the $800,000 mark, rising about 15% over the fast year to a new high of $810,000. Brisbane’s market has also been surging forward, with house prices up almost 14% and units up almost 17% compared to a year ago. The Queensland capital is now Australia’s second most expensive city after Sydney, with a 0.5% uplift in Brisbane’s combined house and unit value ($840,000) in June pushing it ahead of Canberra ($834,000). Both cities were tied for second place last month.

Looking ahead

Despite forecasts of continued price growth, especially in smaller capital cities like Perth, Adelaide, and Brisbane, the pace is expected to slow compared to the rapid increases seen in the past year. PropTrack’s Property Market Outlook Report projects national price increases of 2% to 5% over the next financial year, with Perth leading the way with anticipated growth of 8% to 11%.

In summary, while property prices remain at historic highs, the slower rate of increase provides some hope for buyers amidst ongoing market challenges and economic shifts.

Let us help!

If you’re considering buying or selling a property and seeking to understand the current market conditions, why not chat with one of our friendly agents to understand how we can help?

Or feel free to click here to get your instant property estimate.