No one’s doubting that consecutive interest rate rises, cost of living increases, and stagnant wage growth is a crippling combinations for homeowners.

The rapid increase in interest rates since May has triggered a wave of refinancing as Australians on fixed-rate home loans start to revisit their finances.

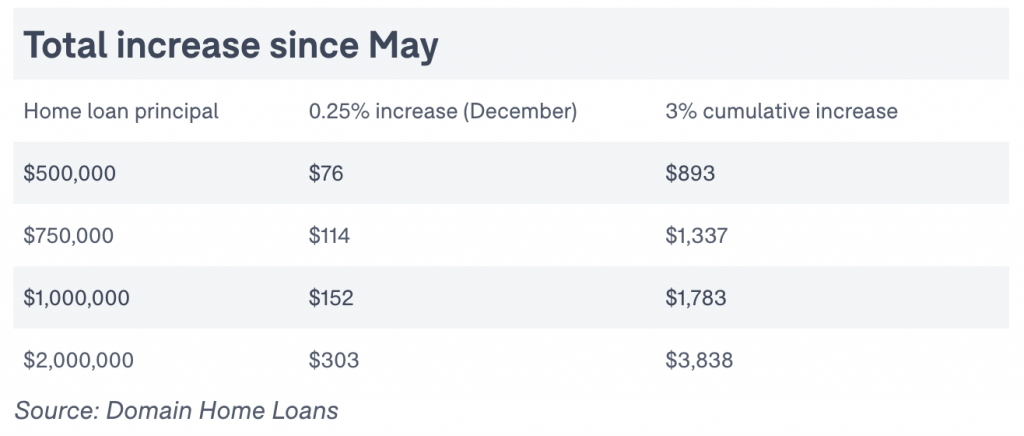

It’s tough. Home Loans shows that for a household with a $1 million mortgage, monthly repayments have already increased by $1783 following Tuesday’s decision by the Reserve Bank to lift rates another 25 basis points.

Homeowners are bearing the brunt, with the target cash rate increasing from 0.1 per cent in April to 3.10 per cent by December – a total increase of 3 per cent in just seven months. The market consensus suggests that the increases could continue into next year, too.

But experts are urging mortgagees to ride the wave to keep a roof over their heads because, even with this year’s rapid spike in repayments, homeowners will be better off financially in the long run.

“With interest rates rising and property prices falling, it can understandably make homeowners feel uncertain about their property journey,” says Dr. Nicola Powell, chief of research and economics at Domain.

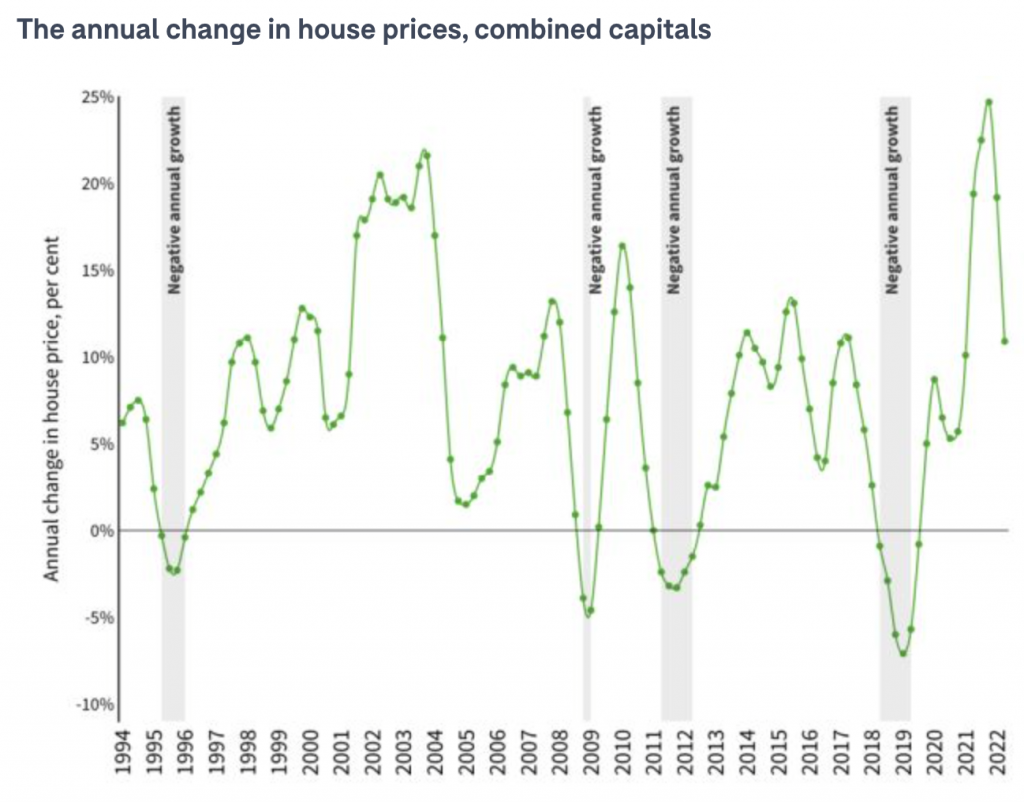

“But our analysis of directly comparing the steepness and duration of an upswing and subsequent downturn since 1995 should provide some bigger-picture perspective,” she says.

Powell says it’s important to understand the cyclical nature of the property market.

“History tells us that downturns don’t last anywhere near as long as upswings do … this downturn won’t last forever,” she says. “So homeowners need to try and keep in mind that it’s not timing the market, but time spent in the market that counts.”

PEXA chief economist Julie Toth says that for the majority of owner-occupiers, buying a home came with a long-term objective and they will typically hold that home for a minimum of five to seven years. Some, she says, will buy with the deliberate intention of creating a home for several decades.

The current cash rate-tightening cycle is the first in more than a decade, and therefore it will be the first experienced for many homeowners, naturally resulting in a level of uncertainty, Toth says.

“If we adopt learnings from the past, especially in relation to property, those with a longer-term outlook should remain optimistic. The Reserve Bank of Australia is targeting inflation, which looks to be peaking now, at around 8 per cent.

“This suggests that rates will also soon peak. Although incomes and wages are beginning to accelerate, they are expected to take a further 18 to 24 months to catch up to inflation and cost of living pressures,” she says.

“If homeowners can cover their mortgage costs over the next one- to a two-year period of rising rates, inflation will eventually subside and incomes will likely catch up.”

Homeowners are responding to the financial squeeze in a variety of ways, says Domain Home Loans Manager Adam Robson.

“Many homeowners are looking at refinancing to try and alleviate the pressure on the household budget. We have seen buyers take a more cautious approach to their purchasing by waiting until the new year to see what happens with the market,” he says.

But with the wave of fixed-rate expiry in 2023, the true impact of interest rate increases on consumer spending will become clear.

“If the interest rate outlook from banks is correct, we are looking at a challenging time for at least another 12 months for mortgage holders,” Robson says.

Make sure you’re getting the best interest rate for your savings account, he adds, and also consider whether taking advantage of the slew of cash-back offers from lenders might ease the pressure on your household budget. Some lenders are offering up to $5000 cash to those who switch over.

For more finance information please contact @realty finance on www.atrealtyfinance.com.au

Source: Domain