Understanding interest rate changes and the implications for home loan repayments is crucial for home owners and buyers alike.

Home owners need to know how much their repayments could rise if interest rates go up. Buyers need to know how rising interest rates could affect their buying power and future mortgage repayments.

The Reserve Bank of Australia (RBA) started raising the official interest rate in May 2022 for the first time in 11 years, with successive rate hikes in the following months.

Borrowers with variable rate home loans have seen their interest rates increase as banks pass on the rate rises to customers.

The cash rate target sits at 2.35 per cent, after a 50 basis point rate hike at the RBA’s September board meeting.

Home loan interest rates are typically a few percentage points higher than the cash rate. Typical variable interest rates for new borrowers sit at about 4.5 per cent.

How could interest rate rises affect home loan repayments?

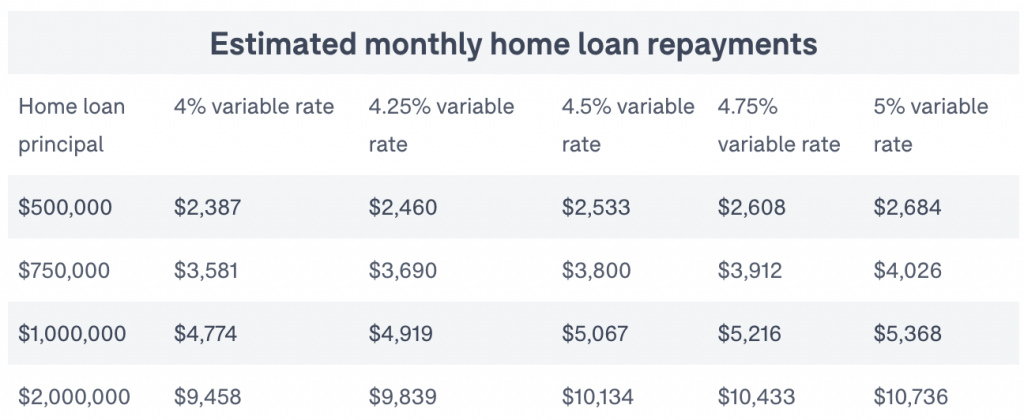

The table below shows how much monthly home loan repayments could rise over the next few months.

The table below shows how much monthly home loan repayments would be at different interest rates and loan amounts.

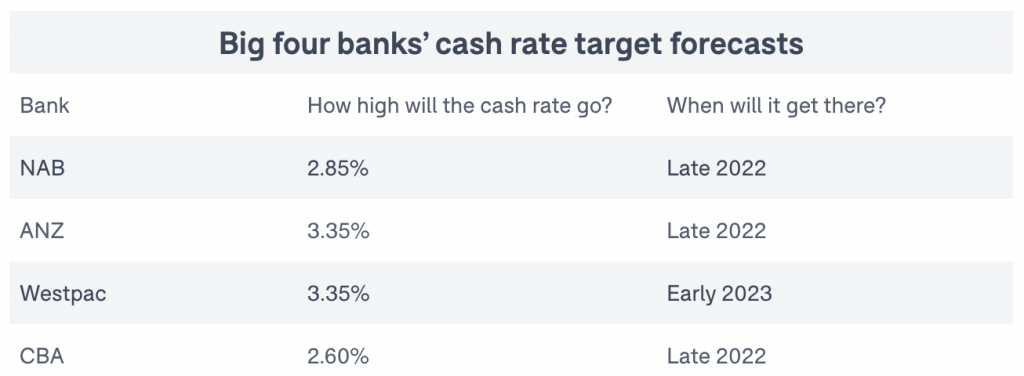

How high could interest rates rise?

It’s anyone’s guess how high-interest rates could go, but the big four banks have predicted rates to keep rising until late 2022 at the earliest.