It’s the million-dollar question on homeowners’ minds: When will interest rates rise and how will that affect home loan repayments?

While economists and the big four banks expect the Reserve Bank of Australia (RBA) to increase the cash rate target from June, no one knows for certain when rates will rise and by how much.

An increase to the cash rate will see borrowers with variable-rate home loans facing higher mortgage repayments, assuming banks pass on rate hikes to customers, which is highly likely.

But whether you’re on a fixed or variable rate home loan, it’s worthwhile reviewing your mortgage before the cash rate increases. So when are interest rates expected to go up and how high are rates predicted to rise?

When will interest rates rise?

The Reserve Bank doesn’t want to raise rates in an election campaign so if interest rates do rise in June, borrowers with variable-rate home loans may have about a month to prepare for an increase in their mortgage repayments.

But how high the cash rate will rise could be the difference between paying tens of dollars or hundreds of dollars more per month.

What could the first interest rate hike be?

The RBA has historically moved the cash rate in 0.25 per cent increments. Therefore, it’s possible the RBA will move in line with historic trends, Mr Oliver says.

“The general expectation is that the first hike will be to get us back to 0.25 per cent, which will be a 0.15 per cent hike,” he says. “Thereafter, the Reserve Bank would move in 0.25 per cent increments.”

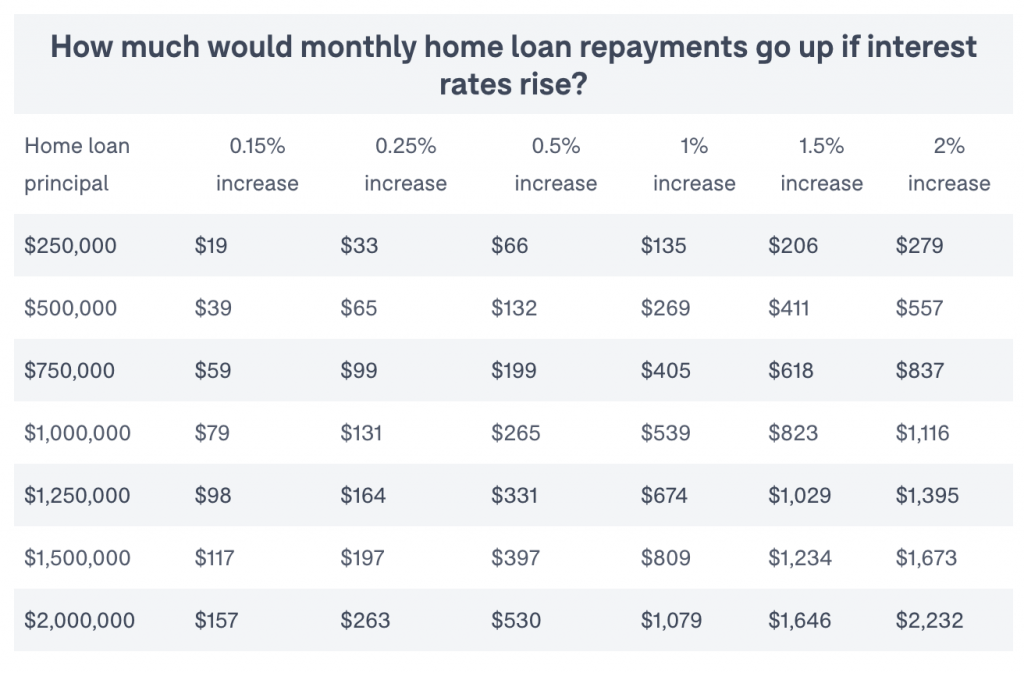

The above table shows the approximate amounts monthly home loan repayments could increase if interest rates rise. Based on a 30-year principal and interest loan with an initial 2.5% interest rate. Information is intended as a guide only. Fees and charges excluded.

If the cash rate increased by 0.15 per cent, borrowers with a $500,000 mortgage on a 30-year term could expect to pay an additional $39 per month on their home loan repayments. For those with a $1 million mortgage, it could mean an additional $79 per month.

However, it’s possible the RBA will conclude that 0.15 per cent is too small of an increase, and may start with a larger hike to show a stronger commitment to keeping inflation down, Mr Oliver says.

“I think this first hike might actually be 0.4 per cent,” he says. “If we work on the basis that the RBA wants to get back to 0.25 per cent increments, they may want [the target] at 0.5 per cent and, to do that, they’ve got to go 0.4 per cent.”

If the cash rate increased by 0.4 per cent, borrowers on the same $500,000 mortgage could expect to pay an additional $106 per month. For those on the same $1 million mortgage, it could mean an additional $211 per month.

How high could interest rates get?

Much like asking when the cash rate will rise, economists will tell you there’s no easy answer when it comes to how high the cash rate will climb over time.

“It’s a bit of a guessing game at this point,” Mr Oliver says. “We don’t know how households will respond to increases in interest rates for the first time since 2010, particularly given that they’re coming from record lows.”

But because of increased levels of household debt, Mr Oliver says the RBA won’t need to raise interest rates to 5 or 6 per cent, as they have done historically, to get inflation back under control.

He expects the cash rate to reach 1 per cent by the end of 2022 and 1.5 per cent by 2023. Thereafter, if inflation substantially decreases, he expects the rate could drop again.

The big banks offer mixed forecasts for the peak of the rate-tightening cycle. Commonwealth Bank expects the cash rate to peak at 1.25 per cent in early 2023, while Westpac predicts a peak of 2 per cent in mid-2023. ANZ expects the cash rate to reach 2 per cent by the end of 2023, and NAB has forecast a peak of 2.25 per cent by the end of 2024.

Source: Link here