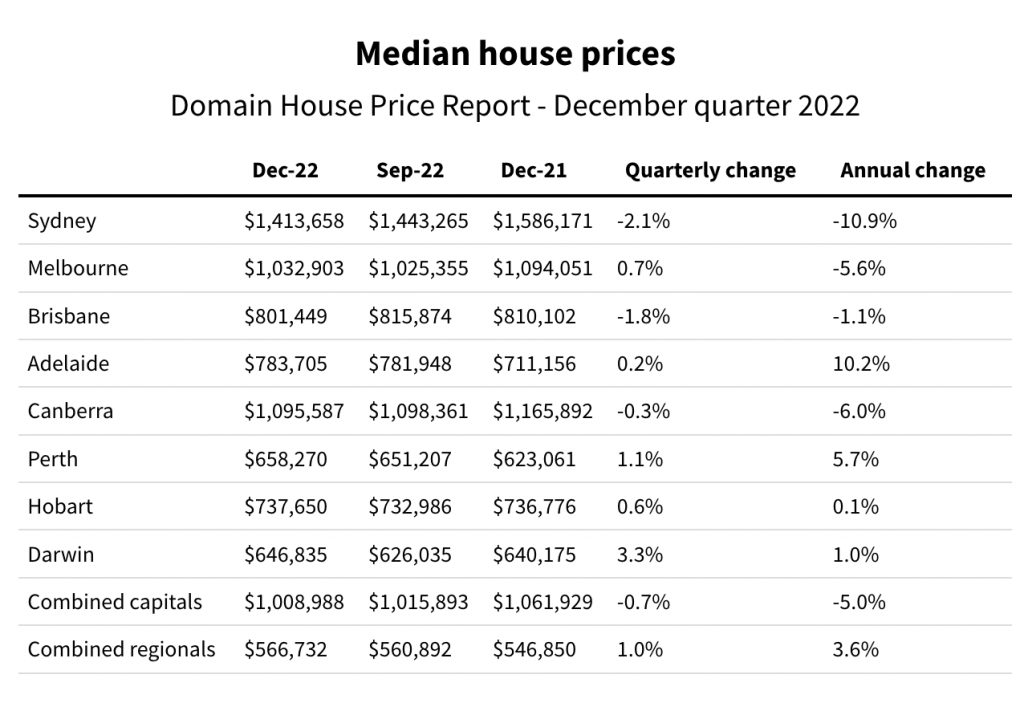

Australia’s property downturn is slowing, the latest data shows, with the steep price falls recorded in September last year easing off to smaller quarterly declines and even stabilising in some cities.

Only Sydney, Brisbane and Canberra fell over the December quarter, the Domain House Price Report revealed on Wednesday, while house prices in Melbourne, Adelaide, Hobart and Perth edged upwards. House prices in Darwin increased by 3.3 per cent.

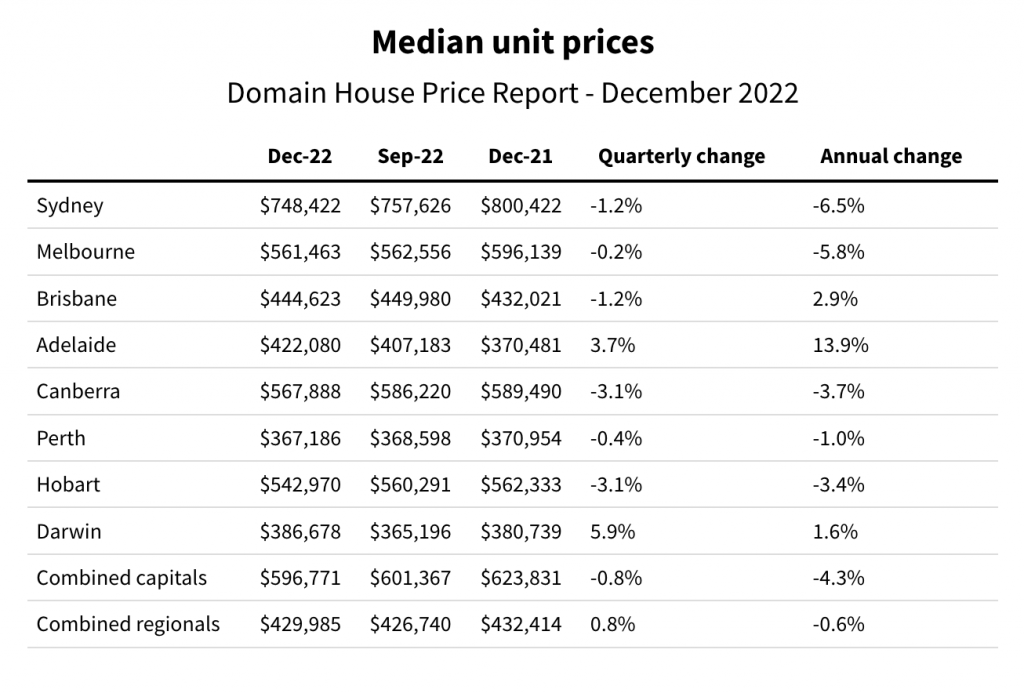

Unit prices were more of a mixed bag, proving resilient in Sydney, Brisbane, Adelaide and Darwin – but Melbourne’s median unit prices are in their fastest decline in history and in Canberra, their fastest decline since 1997.

Nationally, house and unit prices fell by less than 1 per cent over the three months to December.

“The spring selling season bore the brunt of interest rate shocks and sky-high inflation levels,” says Domain’s chief of research and economics, Dr Nicola Powell. “This is why the September quarter saw house prices fall at their fastest quarterly rate.

“Sellers had been sitting on the sidelines to see how the housing market downturn unravelled and how high inflation and interest rates would land.

“Now, in the December quarter, the data suggests that the peak rate of the quarterly decline has passed as buyers have had time to adjust to the new norm of rising debt cost and reduced borrowing capacity.”

The top performing regions in Australia over the quarter were units in Holdfast Bay in Adelaide’s southern coastal suburbs, up 17.5 per cent, units in Bundaberg, Queensland, up 12.9 per cent, and units in the Wagga Wagga and Richmond Valley coastal areas in NSW, both increasing by more than 10 per cent.

The top performing region for house prices in the nation was Dural-Wisemans Ferry in Sydney, where values shot up by 8.5 per cent over the December quarter.

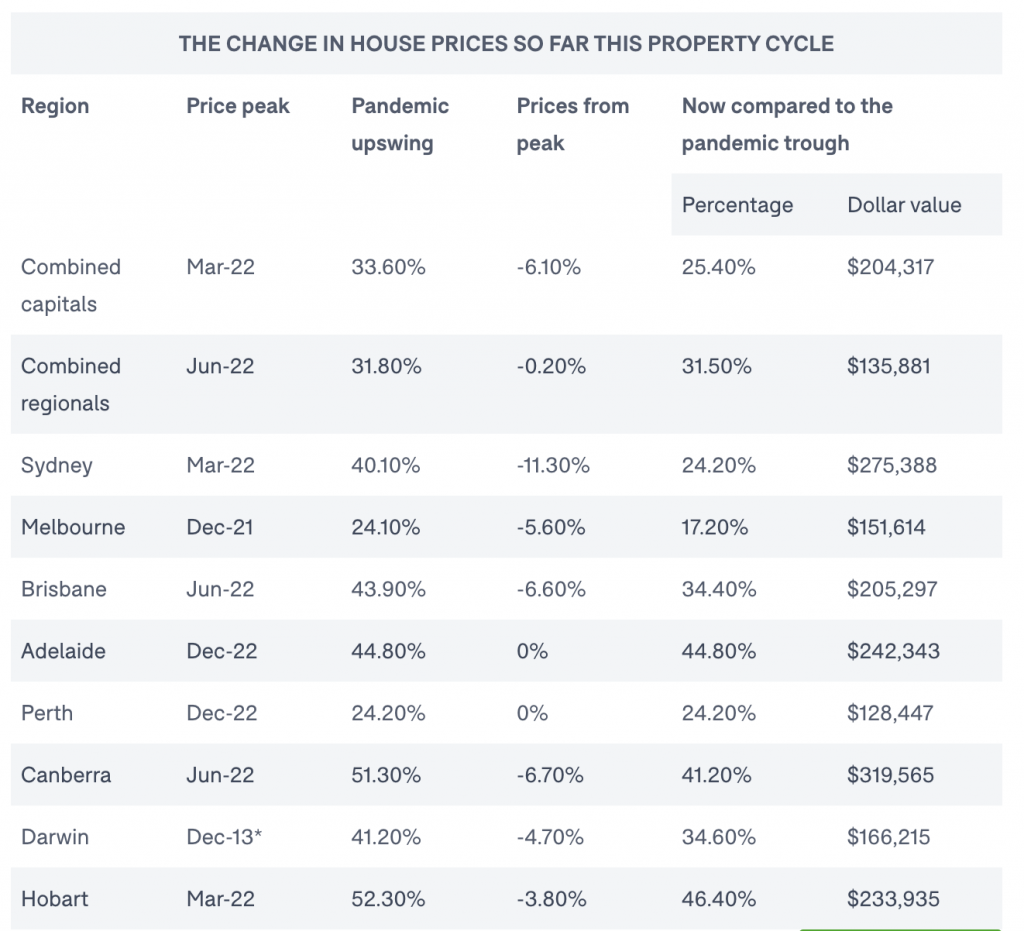

Nationally, house prices have fallen 6.3 per cent from their peak, and Sydney has led the charge – prices are down 11.3 per cent from the peak – followed by Canberra (6.7 per cent) and Brisbane (6.6 per cent).

Sydney’s house prices have fallen for three consecutive quarters, producing the steepest annual decline in the city’s history. Canberra’s story is the same – the steepest annual decline on record – while Brisbane’s annual falls equate to the steepest in a decade.

But house prices have still got a long way to go before the massive gains made during the pandemic property boom are erased. Even with an 11.3 per cent loss, Sydney’s house prices are still 24.2 per cent – or $275,388 – more expensive than they were pre-pandemic.

Canberra’s median is a whopping $319,565 more than it was pre-pandemic and Brisbane’s $205,297.

The outlook for Australia’s property market going into autumn has improved, Powell says.

“While lingering weakness has persisted in the property market, the potential end of interest rates later this year will bring in more buyers and sellers, creating some green shoots for the months ahead,” she says, adding that there are still “possible risks ahead”.

“That doesn’t discount from an unsettled RBA environment and tight serviceability requirements, which will take time for consumers to shake off.

“Based on calculations from Home Loans, those with a $1 million mortgage are now paying almost $1800 more on their loan than this time last year which has been a hard pill to swallow.”