Australia’s Median Home Value Hits $800,000 Despite Slowing Growth Amid Higher Stock Levels

In November, Australia’s national median home value reached a record high of $800,000, marking the 23rd consecutive month of growth. National prices rose 0.15% over the month and are now 5.53% higher than a year ago. However, the pace of growth has slowed, driven by an increase in housing stock, affordability constraints, and the sustained higher interest rate environment.

Strong Demand Meets Rising Supply

The surge in new listings has given buyers more choice, easing urgency to transact and moderating price growth. Despite these headwinds, demand remains robust, supported by factors such as population growth, resilient labour markets, home equity gains, and tight rental conditions.

Multi-Speed Markets Across Capital Cities

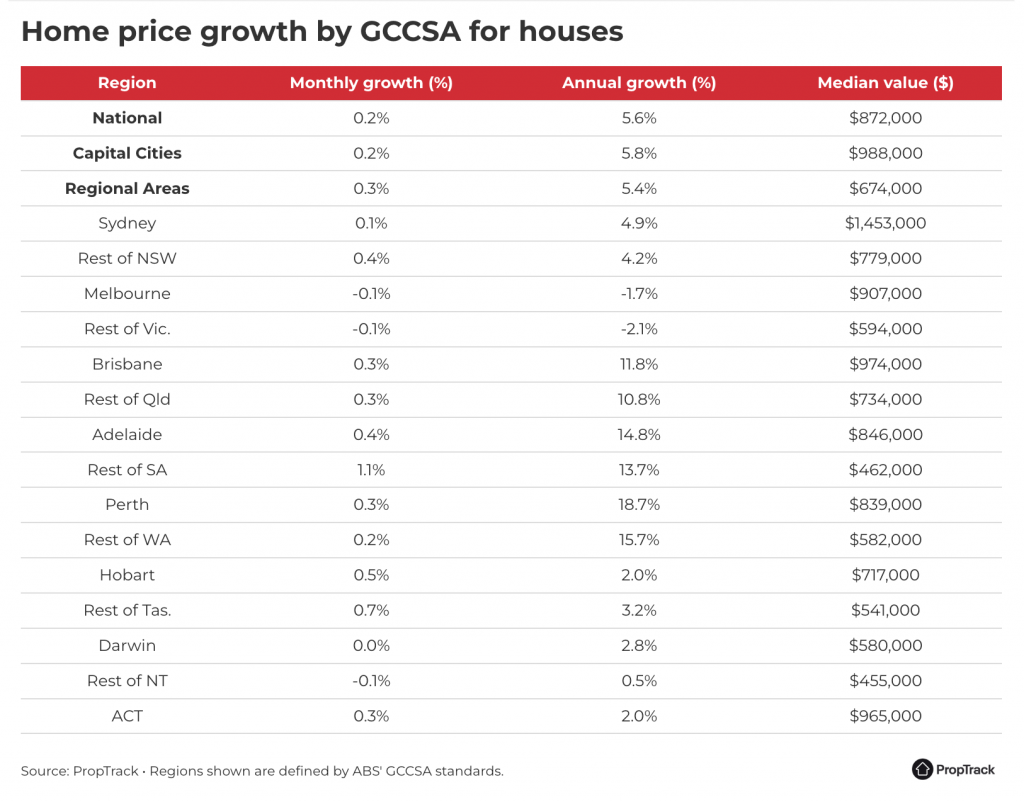

Capital city performance continues to reflect varied market conditions:

- Hobart (+0.43%) and Adelaide (+0.40%) recorded the strongest monthly growth in November, followed by Brisbane and Canberra (both +0.28%).

- Melbourne (-0.07%) was the only capital to record a decline, with prices down 1.63% year-on-year and 4.38% below their March 2022 peak. Melbourne has consistently underperformed due to higher unemployment, increased property taxes, and balanced construction rates relative to population growth.

- Perth, Adelaide, and Brisbane lead annual growth, with prices rising 18.74%, 14.64%, and 12.56% respectively over the past year. These cities continue to benefit from comparative affordability, though this advantage has diminished after years of strong growth.

Hobart saw its first annual price increase (+1.33%) since October 2022, recovering a fifth of its previous declines. However, it remains the weakest capital when comparing changes from peak levels, with values still 7.22% below their highest point.

Regional Markets Outpace Capitals

While annual growth in the combined capitals (+5.55%) slightly exceeded regional areas (+5.48%), regional markets led in November, rising 0.26% compared to the capitals’ 0.11% increase.

- Regional SA (+1.06%) and Tasmania (+0.65%) led November’s growth, while regional Victoria continued to underperform, with prices down 0.05% for the month and 2.09% over the year.

The affordability and demand in regional Queensland, South Australia, and Western Australia, including markets like Townsville and Central Queensland, have driven strong price growth, with median values in these areas remaining under $500,000.

Houses Outperform Units

House prices lifted 0.19% nationally in November, outpacing units, which recorded a slight 0.05% decline. Over the past year, houses (+5.64%) have consistently outperformed units (+4.99%). However, since the pandemic, affordability pressures and renewed interest in urban living have narrowed this gap.

Outlook

Despite slowing growth, prices are expected to remain positive in the coming months. Elevated population growth, improving rental affordability, and resilient demand are key factors supporting the market. Although rising stock levels and affordability constraints weigh on growth, demand is likely to remain strong, buoyed by tax cuts and stable labour market conditions.

Once interest rates begin to fall next year, affordability will improve, likely fuelling increased buyer activity and confidence.

The PropTrack Home Price Index, which measures monthly residential property price changes, highlights these trends and offers insights into current market performance.

Let us help!

If you’re considering buying or selling a property and seeking to understand the current market conditions, why not chat with one of our friendly agents to understand how we can help?

Or feel free to click here to get your instant property estimate.