Home Prices Hit Record Highs as Market Momentum Builds

Home prices across Australia and New Zealand continued to rise in March, driven by renewed market momentum following the Reserve Bank’s February rate cut.

The rate cut boosted borrowing capacities and buyer confidence, helping to reignite demand and reverse the small price declines seen in the months prior.

@realty recorded another successful month, selling $526,985,544 worth of property across the region—marking a 30.67% increase from last year’s sales.

Key Market Trends – March 2025 Report

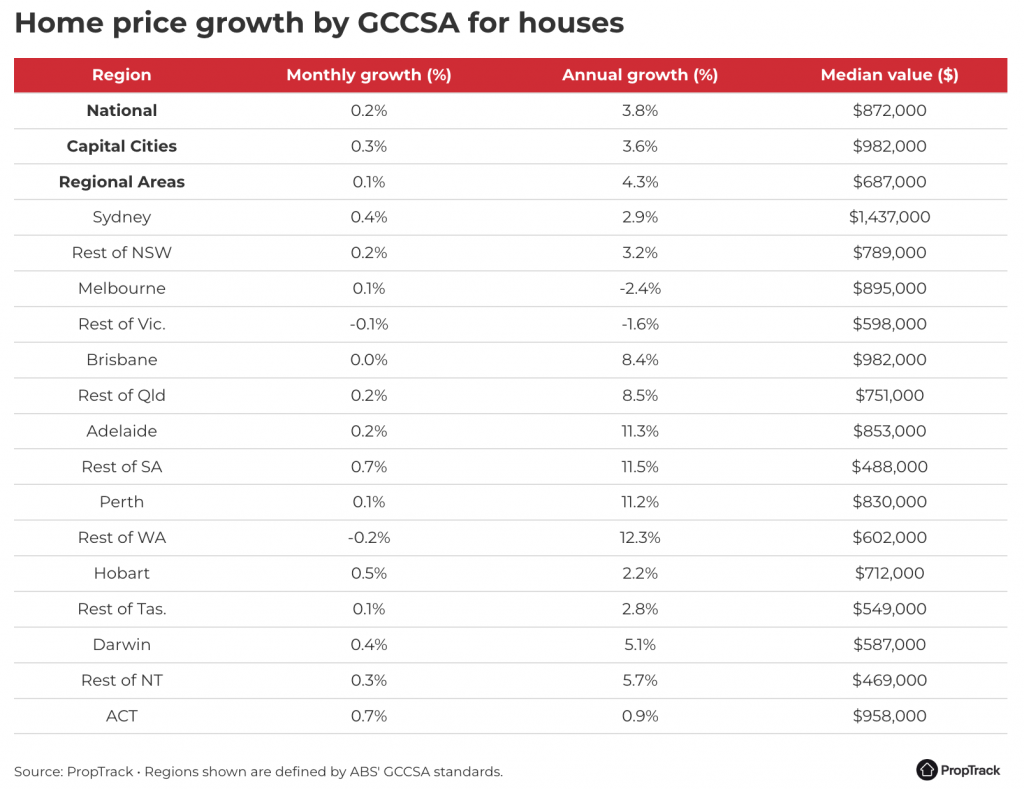

- National home prices rose 0.27% in March, pushing values to an all-time high. Prices are now 3.91% higher than a year ago and 48% higher over the past five years.

- Capital cities led the gains, with prices rising 0.31%, while regional markets saw a 0.18% increase. Both segments reached new record highs.

- Canberra (+0.54%) and Sydney (+0.47%) led price growth, while Brisbane (+0.07%), Adelaide (+0.18%), and Perth (+0.15%) saw more modest increases. Despite this, these three cities remain the top performers over the past year, with values up 9.39%, 11.32%, and 11.53%, respectively.

- Melbourne, Canberra, and Sydney saw the strongest quarterly growth turnaround, following slower conditions in late 2024.

- Growth has slowed in Adelaide, Brisbane, and Perth, after strong momentum in 2023-24.

- While capital cities are leading the price rebound, annual growth in regional areas (+4.59%) continues to outpace capital city growth (+3.64%). Affordability challenges and increased housing availability tempered capital city growth in 2024, but the February rate cut reignited buyer demand.

Market Sentiment and Buyer Confidence

Following February’s rate cut, national home prices continued to trend upward in March. The cut boosted borrowing power, increasing buyer confidence and re-engaging those who had postponed purchasing decisions. While the direct impact of the 25-basis-point cut may only raise an individual’s borrowing capacity by 2-3%, overall market sentiment plays a significant role in driving demand.

Improved affordability and expectations of further price growth are encouraging more buyers to enter the market. Capital cities are leading the recovery, with prices lifting 0.31% in March, compared to 0.18% growth in regional areas.

House vs. Unit Price Trends

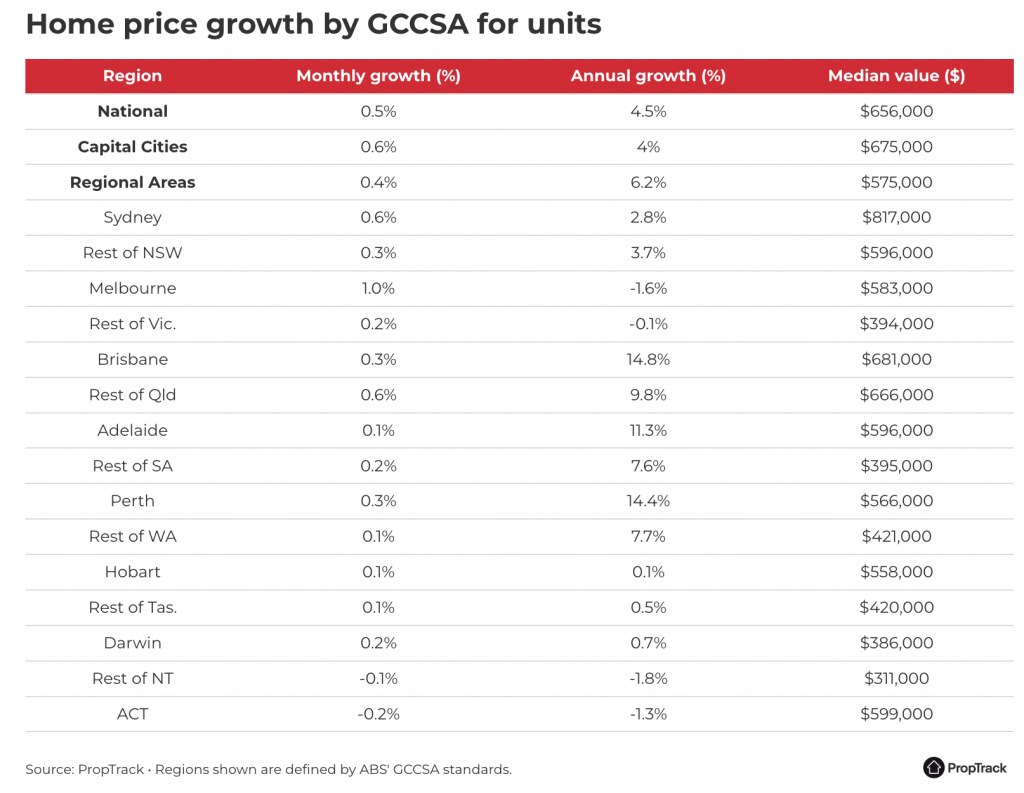

- House prices increased 0.22% in March, while unit prices rose 0.53%.

- Over the past year, house values are up 3.78%, while unit prices have risen 4.51%.

- Since the pandemic, house values have surged 53%, compared to 28% for units, reflecting the increased demand for space and land. However, affordability constraints and renewed interest in city living have narrowed this performance gap in recent years.

Regional and Affordability Trends

Markets in regional Queensland, South Australia, and Western Australia continue to experience strong growth. Despite recent rate cuts, high interest rates over the past year and lagging wage growth have contributed to affordability challenges.

Across capital cities, more affordable areas have outperformed, with heightened demand pushing up prices in lower-priced regions such as Adelaide’s north, Ipswich, and Perth’s northwest and south.

The Outlook: What’s Next for Home Prices?

February’s rate cut played a key role in boosting buyer confidence and lifting home prices. Beyond interest rates, other structural factors—such as strong population growth and a shortage of new housing supply—continue to support price appreciation.

However, affordability remains a major challenge, and further improvements will likely be gradual. While home prices are expected to continue rising in the coming months, the pace of growth will likely moderate, especially as affordability constraints limit further price surges.

With measured rate reductions expected ahead, the market is poised for continued growth, albeit at a more sustainable pace.

Let us help!

If you’re considering buying or selling a property and seeking to understand the current market conditions, why not chat with one of our friendly agents to understand how we can help?

Or feel free to click here to get your instant property estimate.