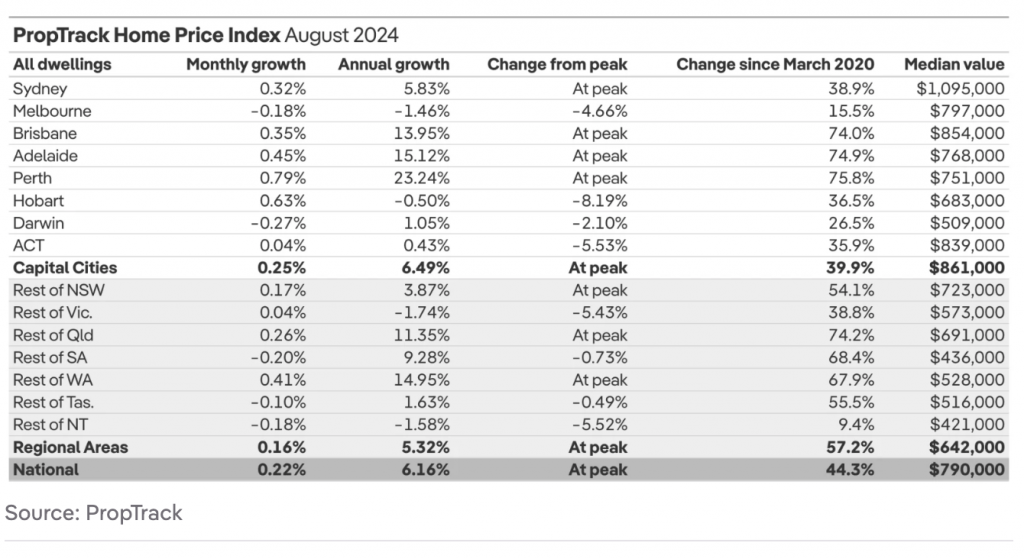

Homebuyers across Australia are experiencing relief as home price growth continues to slow while the country enters its busiest real estate period. The spring market, which typically sees an increase in new property listings, coincides with a modest national median home price rise of 0.22% in August, bringing the figure to $790,000, according to the latest PropTrack Home Price Index.

Despite this slowdown, national home prices are still 6.16% higher than last year and have surged by 44.3% since the onset of the pandemic in early 2020.

National home prices have seen 20 consecutive months of growth, although the pace has decelerated due to seasonal factors. The increase in homes hitting the market, combined with strong population growth, tight rental markets, and home equity gains, continues to bolster demand. However, challenges in building activity are exacerbating the ongoing housing shortage.

Price growth remains supported by recent tax cuts that boosted borrowing capacities, enabling buyers to stretch their budgets further. The persistent rise in home prices is motivating many buyers to overcome affordability challenges, keeping demand strong across the country.

However, price growth varies across regions, driven by the balance between supply and demand. While home prices are expected to rise as the spring selling season ramps up, the increase in property choices, uncertainty around interest rate cuts, and ongoing affordability constraints may slow the pace of growth.

Perth outperformed the rest of the country in August, with home prices up 0.79% from the previous month. Perth’s median home price climbed to a new peak of $751,000, reflecting a 23.24% year-on-year increase. The mood in Perth’s property market remains optimistic, with both buyers and sellers expecting continued strength, albeit at a slower pace than in the past two years.

Despite the positive sentiment, competition among buyers is fierce, with some facing up to 10 rivals for the same property. In Adelaide, the median home price rose 0.45% in August, reaching a new high of $768,000, representing 15.12% growth over the past year. Brisbane also saw gains, with a 0.35% increase bringing its median home price to $854,000, marking a 13.95% annual rise.

Sydney’s median home value grew by 0.32% in August, reaching a new peak of $1.095 million, up 5.83% annually. In contrast, Melbourne’s median home price dipped 0.18% to $797,000, and over the past year, the city’s average home price declined by 1.46%. While Melbourne sellers may not see the same gains as those in Perth and other markets, there are more homes available for purchase, offering opportunities for first-home buyers. However, investors who entered the market during the low-interest-rate period may be disappointed, as rising costs make it more challenging to hold onto properties.

Smaller capital cities displayed mixed results, highlighting the varied nature of the Australian property market. Hobart’s median home price increased 0.63% in August to $683,000, though it was 0.5% lower compared to last year. Darwin saw a 0.27% decline in its median home price to $509,000, while still recording a 1.05% annual gain. Canberra’s median home price edged up 0.04% to $839,000, marking 0.43% growth over the past year.

Overall, capital cities recorded combined annual growth of 6.49% in August, while regional areas saw slightly lower annual growth of 5.32%. Regional Western Australia led the way, with the median home price up 0.41% for the month and a strong 14.95% annual increase. Regional areas in Queensland, South Australia, and New South Wales also saw solid annual growth of 11.35%, 9.28%, and 3.87%, respectively. In contrast, regional markets in Victoria and the Northern Territory experienced declines of 1.74% and 1.58% over the 12 months to August.

Let us help!

If you’re considering buying or selling a property and seeking to understand the current market conditions, why not chat with one of our friendly agents to understand how we can help?

Or feel free to click here to get your instant property estimate.