Home Prices Reach Record Highs in February Following Interest Rate Cut

National home prices surged to new highs in February after the Reserve Bank lowered the official interest rate, reversing the sluggish start to the year. Prices climbed 0.40% over the month, bringing national values 3.94% higher than a year ago.

Key Findings from February 2025:

- National Price Growth: Home prices rose 0.40% in February, setting a new record and recovering from recent declines. Prices are now 3.94% higher year-on-year.

- Capital Cities Lead the Rebound: After driving price dips in previous months, capital cities saw a 0.45% rise in February, outpacing the 0.28% increase in regional areas. Both markets are now at record highs.

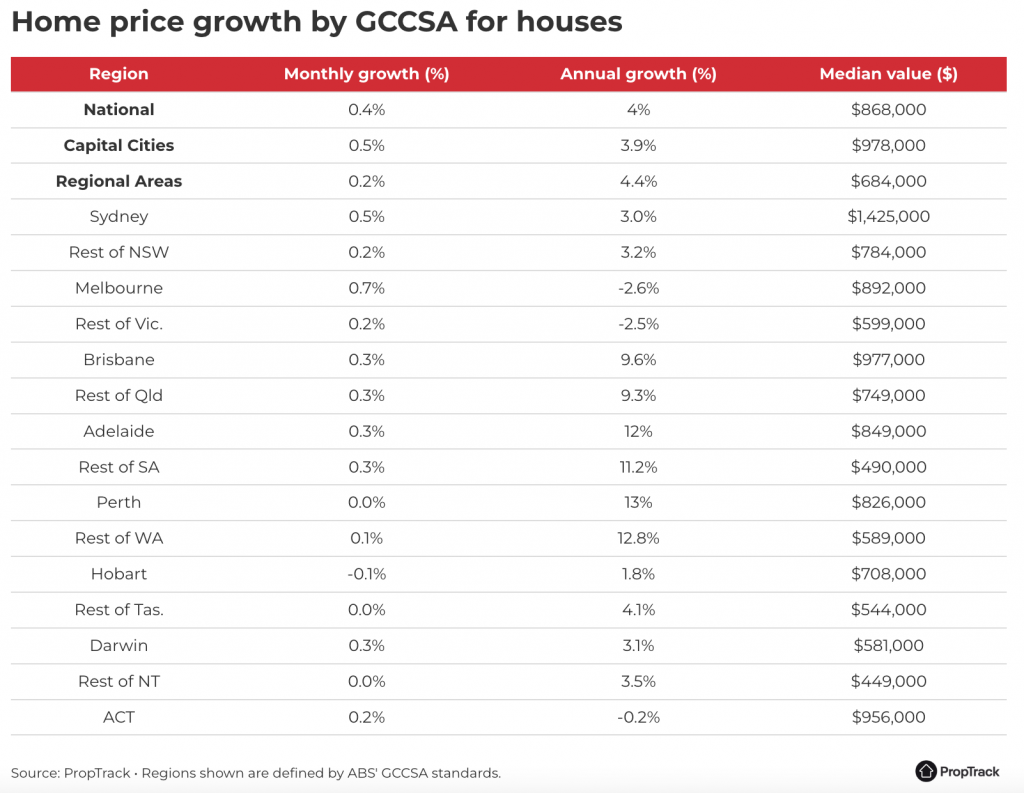

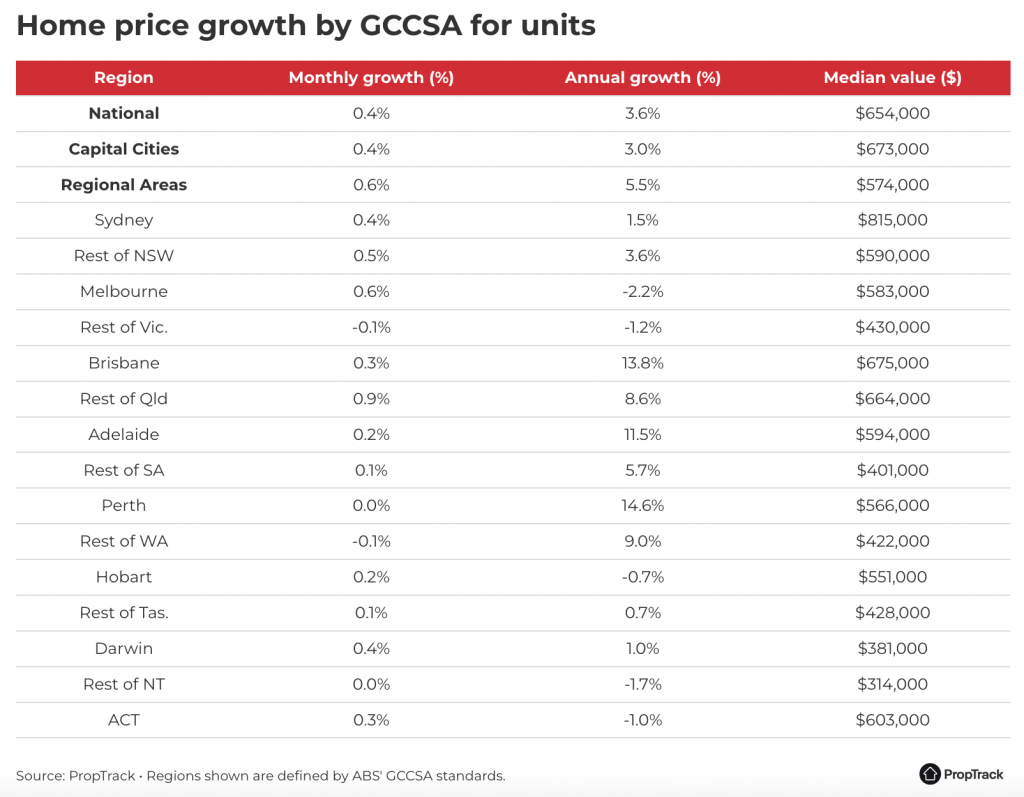

- City-Level Performance: Melbourne (+0.67%) and Sydney (+0.50%) led price growth in February, while Hobart (-0.03%) was the only capital to experience a decline. Melbourne recorded its strongest gains in house and unit prices since early 2020.

- Quarterly Growth Trends: Behind Darwin, Melbourne and Sydney experienced the fastest quarterly price acceleration, while Adelaide, Hobart, and Perth saw a slowdown.

- Regional vs. Capital Growth: Despite the capital city rebound, regional areas have outpaced them in annual growth (+4.54% vs. +3.70%), influenced by affordability constraints and increased housing supply in urban areas.

- Top Performing Markets: Over the past year, Perth (+13.12%), Adelaide (+11.91%), and Brisbane (+10.21%) have been the strongest capital city markets, despite a recent slowdown in growth.

Market Sentiment Improves with Interest Rate Cuts

With interest rates beginning to decline, market sentiment has strengthened. Auction clearance rates rose across all major cities in early February, reflecting renewed buyer confidence. The 25 basis point rate cut slightly increased borrowing capacities—by an estimated 2-3%—but psychological factors like optimism and market expectations also contributed to rising demand and price growth.

House and Unit Prices on the Rise

In February, house prices grew by 0.39%, while unit prices increased by 0.44%. Over the past year, house values have risen 4.01%, slightly outpacing unit price growth at 3.59%. However, the long-term trend since the pandemic has shown a stark contrast: house values have climbed 52%, compared to a 26% rise for units.

While house price growth (2.98%) exceeded unit growth (1.50%) in Sydney over the past year, Brisbane saw the opposite trend, with unit prices soaring 13.79% compared to 9.57% for houses.

Affordability Challenges and Shifting Demand

Despite February’s rate cut, affordability remains a major issue. Interest rates have been high for much of the past year, and home price growth has significantly outpaced income increases, making it harder for buyers to enter the market. More affordable regions within capital cities—such as Adelaide’s north, Ipswich in Brisbane, and Perth’s northwest and south—have seen particularly strong demand and price appreciation.

Future Outlook

Looking ahead, home prices are expected to continue rising, with additional interest rate cuts likely to support market growth. However, affordability challenges and structural issues, such as population growth and limited housing supply, could moderate price gains compared to past rate-cutting cycles.

While the pace of growth has slowed in some areas, Perth remains the strongest-performing capital city, with 13.12% annual price growth. Factors such as relative affordability, strong population growth, and constrained housing supply have contributed to this sustained strength.

Overall, the combination of lower interest rates, improved borrowing power, and strong demand is expected to keep home prices on an upward trajectory in 2025, albeit at a more measured pace compared to previous years.

Let us help!

If you’re considering buying or selling a property and seeking to understand the current market conditions, why not chat with one of our friendly agents to understand how we can help?

Or feel free to click here to get your instant property estimate.