Australian Home Prices Reach New Heights Amid Spring Selling Surge

In October, Australia’s housing market saw a renewed boost, with national home prices rising by 0.26%, reaching record levels as spring’s peak selling season brought eager buyers back into the market. This uptick follows a slowdown over winter and early spring, marking a rebound for the sector. It also extends the housing market’s growth streak to 22 consecutive months, with demand remaining resilient despite affordability challenges.

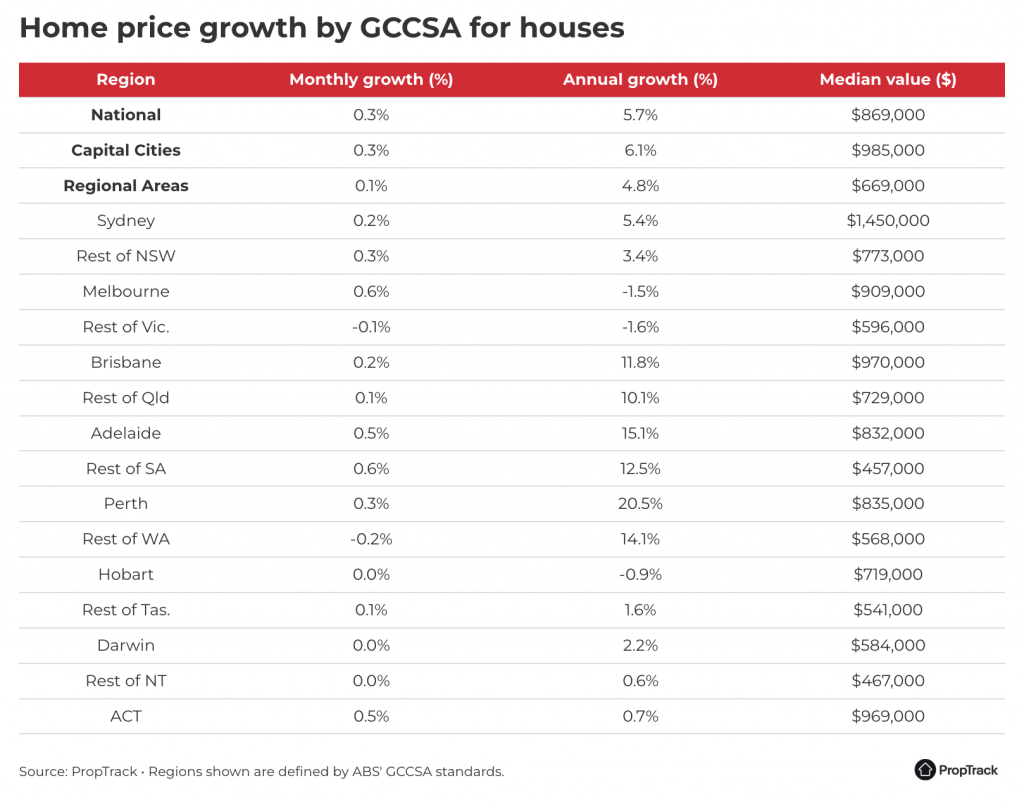

More properties hitting the market in October increased options for buyers, helping to moderate the overall pace of price growth. Yet, prices rose across most capital cities except Brisbane, Adelaide, and Darwin, where growth remained tempered compared to the summer season’s higher rates. Regional disparities in housing growth are evident, driven by varying supply-demand dynamics across areas.

Key Insights from October 2024 Housing Data:

- National Price Increase: Home prices rose 0.26% to a new high, now 5.62% above October 2023 levels.

- Capital City Gains: Combined capital city prices climbed 5.85% year-over-year, with a 0.28% increase in October. However, results varied across different cities.

- Melbourne Recovery: Melbourne led the capitals in monthly growth, with a 0.49% rise after six consecutive months of declines.

- Leading Growth Cities: Perth, Adelaide, and Brisbane posted the highest annual gains among capitals, with prices up 20.58%, 14.91%, and 12.51% respectively.

- Regional Performance: Regional areas saw a 0.20% lift in October and remain 5.03% above year-ago levels. Regional South Australia (+0.57%) and Queensland (+0.34%) led growth, while regional Victoria recorded an annual decline of 1.51%.

Market Dynamics and Regional Variations

Perth and Adelaide continue to benefit from a comparatively affordable housing market and tight rental conditions, supporting demand and driving persistent price increases. Perth has emerged as one of the nation’s hottest markets, with rapid price growth following years of lagging behind eastern capital cities. Despite more listings, low stock levels have sustained competitive conditions in Perth and Adelaide, with homes quickly absorbed by strong buyer demand.

In Melbourne, prices rose by 0.49% in October, potentially signaling a turning point after recent underperformance. While Melbourne ranked as Australia’s fourth most expensive city in October, the increase reflects heightened activity in spring. However, affordability and higher property taxes remain limiting factors in Victoria, particularly for investors.

House vs. Unit Market Trends Nationally, house prices rose by 0.27% in October, slightly outpacing unit prices, which increased by 0.19%. House values remain 5.71% higher than last year, whereas unit values have increased by 5.14%. Since the pandemic, house prices have surged 50%, while unit values have seen a 26% rise, reflecting the shifting demand for space.

Looking Ahead

The reacceleration of home prices suggests strong demand, supported by population growth, tight rental markets, and steady equity gains. Building activity remains challenged, exacerbating the housing shortage. Despite more properties becoming available, high interest rates and affordability constraints could weigh on future growth. Yet, with sustained demand and limited supply, the market is expected to see continued gains as the year progresses.

While Australia’s housing market remains robust, regional and city-specific performance continues to reflect varied local conditions, showing how supply, demand, and affordability play distinct roles across the country.

Let us help!

If you’re considering buying or selling a property and seeking to understand the current market conditions, why not chat with one of our friendly agents to understand how we can help?

Or feel free to click here to get your instant property estimate.