Property price growth has varied across Australia, with values continuing to rise rapidly in many areas, but overall growth is slowing.

In July, property prices increased again, pushing the median national home value to a new record high, as reported by the latest PropTrack Home Price Index. However, the marginal 0.08% increase over the month marks a significant slowdown compared to previous months, indicating worsening housing affordability. This was the smallest monthly increase since prices stopped falling in late 2022.

While national prices are still on the rise, the pace of growth has decelerated. This slowdown is partly seasonal but also reflects increasing affordability constraints.

The slowdown was expected, coinciding with continued strong listing activity and July being the seasonally weakest month for home price growth.

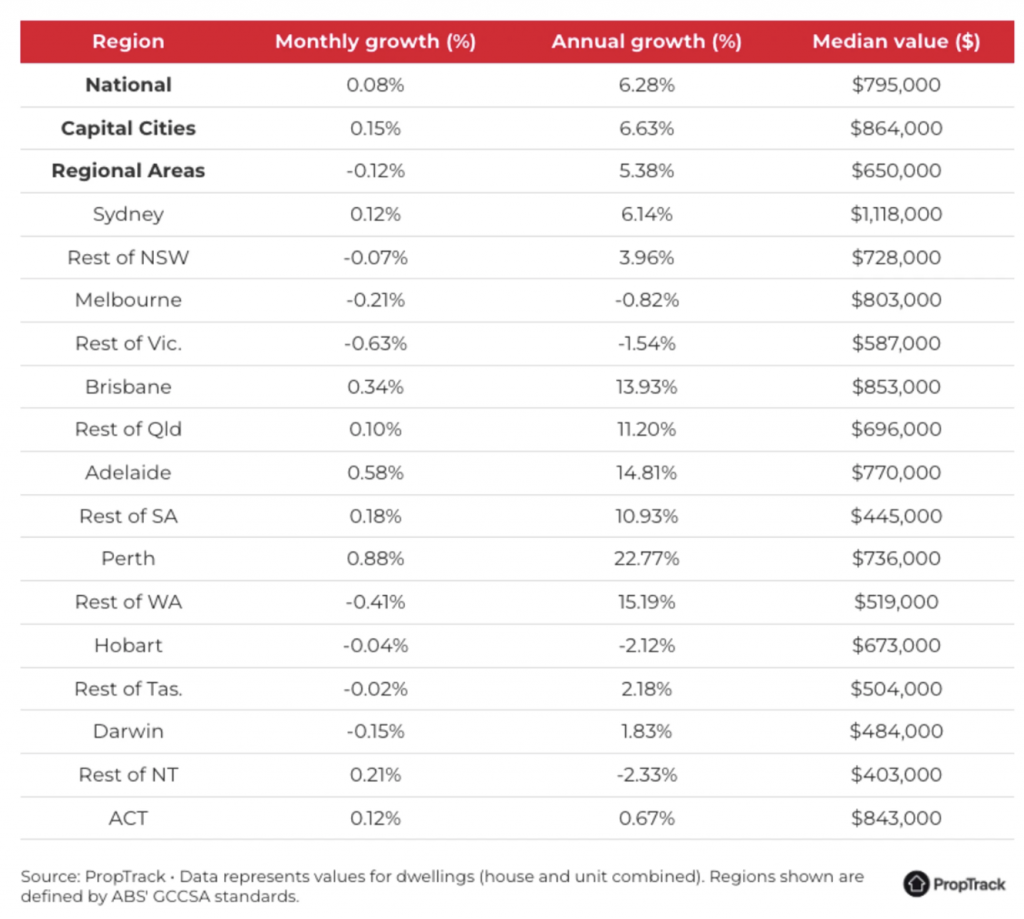

Analyzing price movements at the capital city and regional levels reveals significant differences, with affordability and supply variances causing prices to move at different rates. Half the capitals are still experiencing strong growth, while the others lag or see declines.

Rapid or moderate price growth is seen in Perth, Adelaide, Brisbane, and Sydney, while other capitals exhibit subdued or negative growth.

Despite strong housing demand, tight rental markets, and rebounding investor activity across all markets, differences in affordability and home construction are driving divergent outcomes. More affordable regions have performed best, driven by affordability challenges from the high-interest rate environment.

Where home prices are surging:

- Perth: Strongest annual growth at 22.8%, with a 0.88% increase in July. A typical Perth house is now worth $790,000, and the median apartment value is $530,000.

- Adelaide: 0.58% growth in July, with a 14.8% annual increase. Its median home value is just $33,000 lower than Melbourne’s.

- Brisbane: 0.34% growth in July, with a 13.9% annual rise. Brisbane recently overtook Melbourne as Australia’s second-most expensive capital after Sydney.

- Sydney: 0.12% increase in July, with a 6.28% annual rise. Prices in more affordable parts of Sydney have increased by up to 10% over the year, while pricier areas rose by 3% to 5%.

Where prices are flat or falling:

- Melbourne: Declined for the fourth consecutive month, with a 0.21% fall in the citywide median value. Prices are now 0.82% lower than a year ago.

- Canberra: Recorded a 0.12% rise in July, with a 0.67% annual increase.

What’s next for property prices?

Prices are expected to keep rising after the slower winter period, especially with boosts to buyers’ budgets from rising incomes and tax cuts. Continued strong income growth and stage three tax cuts have increased disposable incomes and borrowing capacities. The outlook for interest rates remains crucial, but a recent quarterly inflation result in line with expectations makes it likely that rates will remain on hold when the RBA meets in August.

Overall, modest home price growth is expected over the coming months as the market moves into the traditional spring selling season.

Let us help!

If you’re considering buying or selling a property and seeking to understand the current market conditions, why not chat with one of our friendly agents to understand how we can help?

Or feel free to click here to get your instant property estimate.